Nonprofit organizations rely on recurring donors to help them deliver on their mission. Not only do they provide consistent monthly revenue but, according to Philanthropy News Digest, recurring donors give 440% more than one-time donors. That means the process of moving those accounts from one payment gateway or fundraising platform needs to be as smooth as possible. Hiccups in the process could trigger donors to change their contributions or stop contributing altogether. If you are considering moving your recurring donors (also referred to as “sustainers”) from one payment platform to another, there are a few considerations to keep in mind and some key stumbling blocks to look out for as you begin the process.

Nonprofit organizations rely on recurring donors to help them deliver on their mission. Not only do they provide consistent monthly revenue but, according to Philanthropy News Digest, recurring donors give 440% more than one-time donors. That means the process of moving those accounts from one payment gateway or fundraising platform needs to be as smooth as possible. Hiccups in the process could trigger donors to change their contributions or stop contributing altogether. If you are considering moving your recurring donors (also referred to as “sustainers”) from one payment platform to another, there are a few considerations to keep in mind and some key stumbling blocks to look out for as you begin the process.

First, determine whether you should attempt to migrate sustainers based on how many you have. If, for example, you have only a couple dozen sustainers and they are mostly board members, simply asking them to renew their commitment to your new platform might be more beneficial. A good measure is to compare the annual value of your donor program to the cost associated with moving donors. This includes the value of your time, costs that you will incur from consulting firms, and fees charged by your current vendors for providing you with your data. If the costs outweigh the value of your current program, consider emailing sustainers with a link to the new donation page.

Another consideration is how well you understand your data. While moving your constituents’ information from one system to another is typically straightforward, moving payment data and gift schedules associated with recurring donations is more complex. Understanding where and how the data is stored can help. Only then can you grasp what might be involved in the migration.

Protecting Payment Card Data

While you know it is important to keep all of your constituents’ data safe, it is even more important to keep raw credit and debit card data secure because it is subject to Payment Card Industry (PCI) compliance. Raw payment (card or ACH) data is rarely viewable in your database; instead, you typically see the last four digits of the card or account number and an alphanumeric string.

A donor’s primary account number (PAN) is replaced with a randomly generated number, or “token.” The token is created by your payment gateway, where the full raw payment card data is securely stored. Tokens are unique to a payment gateway, which adds to their security. Each month, when a recurring donation needs to be charged, the token is sent to the payment gateway without the worry of exposing the credit card data. Meanwhile, your donors’ data and gift schedules are typically stored in your CRM or fundraising platform.

While tokens play a key role in protecting your donors’ raw payment data, they can also hinder the migration process. Below are five common stumbling blocks to be wary of your migration journey.

Data Resides in Multiple Vendors’ Systems

Having your recurring donation data in two systems — your payment gateway and your fundraising platform — is the first reason such a move is so complex. With the data residing in disparate systems, the ability to simply export from one system to the other is hindered. Additionally, you will need identifiers to match up your separate files.

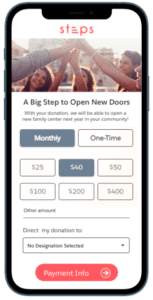

Not All Vendors Can Import Recurring Gifts

It’s imperative that your new fundraising platform and payment gateway can import existing recurring gifts; some platforms do not support this. Be sure to read the contracts for your new vendors to determine if they will allow you to move your data in the future and, if so, whether they will charge you for it. Salesforce.org Elevate allows you to import recurring donations and their payment tokens. In addition, you can always export your donor and gift data from Salesforce CRM.

Transferring Raw Payment Card Data Requires Coordination Among Your Vendors

Because of PCI compliance and the tokens vendors use to abide by it, transferring payment data is more complex than transferring other types of data. If your new fundraising platform includes a payment gateway, the raw payment information should be sent directly to your fundraising platform. Make sure to coordinate the transfer of raw payment information from your existing payment gateway vendor to your new vendor. Most payment gateways will honor such requests, but they will not send raw payment data directly to a merchant, nonprofit, or school.

Not All Vendors Are Cooperative

Some payment gateways or fundraising platforms may hesitate or refuse to provide your new payment gateway with the payment card data because they do not want to lose your business; some may even charge you a fee. These stipulations should be spelled out in your contract with your payment gateway or fundraising platform. To avoid issues, carefully review the contracts of your current and new vendors.

Mistiming Your Migration Can Be Costly

Once you are ready to make the move, ensure your timing is on point. You don’t want to miss a donation or double-charge your valuable sustainers. Here’s how to time it right:

- Set up your new gateway and fundraising platform first. This will ensure that you are ready to process your recurring donors that you are moving over. It will also allow you to start processing the new recurring donors on your new platform, so you have a clean break in time between the old and new system.

- Next, move your payment data to your new gateway. You will need both the old payment token and the new token. The old token will be used to tie the payment data to the gift data in your CRM or fundraising platform. The new token will need to be added to the platform for future processing.

- Lastly, you will need to move your recurring gift schedules (and associated donor data if it has not already been moved) to your new system.

Before moving all of your data over, best practices are to test with a small subset of data, such as 5–10 sustaining donors to ensure the process worked correctly.

The process of moving sustaining donors can be daunting, and there are many nuances not addressed in this article, but you don’t have to do it alone. Get help from experts in this space, such as Cloud for Good, who can guide you through the migration process.

Additionally, learn more about recurring donor programs and payment processing by downloading the Guide to Selecting a Payment Processor. This guide, which was created for fundraisers and CRM administrators, will help you understand the nuances of moving sustainers and gain insight into payment processing.

Learn More About Lori Borg

Lori leads product marketing for Salesforce.org Elevate, Salesforce’s new fundraising suite for nonprofit and educational institutions, which includes Salesforce.org Payment Services and Giving Pages. Lori has an extensive nonprofit background, from serving as executive director, to board member, to volunteer fundraiser. She currently serves on the board of ArtReach, a nonprofit that takes visual art to under-served children in San Diego, CA. She has 10 years of nonprofit payments expertise and has presented in nonprofit conferences and webinars on fundraising, payments, data hygiene, and sustaining donor programs. Lori earned her MBA at Loyola Marymount University in Los Angeles.